To cash a check at Walmart, you have to endorse your check by signing on the back of the check. Then you bring your endorsed check and ID to a Walmart Money Center or Customer Service Desk. Once you have been approved and paid the Walmart fee, you will be able to get your cash.

To make this process smooth, you should know these 5 things:

- Know which Walmart location will cash checks

- Know what you need to bring with you to check checks

- Know where to go and how to cash checks

- Know what to do if your check got denied

- Know alternative places to go to cash a check

Before you can cash your check, you need to endorse the check first. Endorsing a check means signing your name on the back of the check.

When people get paid with checks, it is common practice for them to sign the back of the checks before they deposit the checks into their banks.

When cashing a check at Walmart, you are required to endorse it or Walmart will not cash it.

Moreover, make sure your check or money order is in good physical condition. As part of the check cashing process, Walmart will use a scanning machine to read your check.

If your check has wrinkles, tears, or smudges, the machine may not be able to read it probably. In that case, your check will be denied.

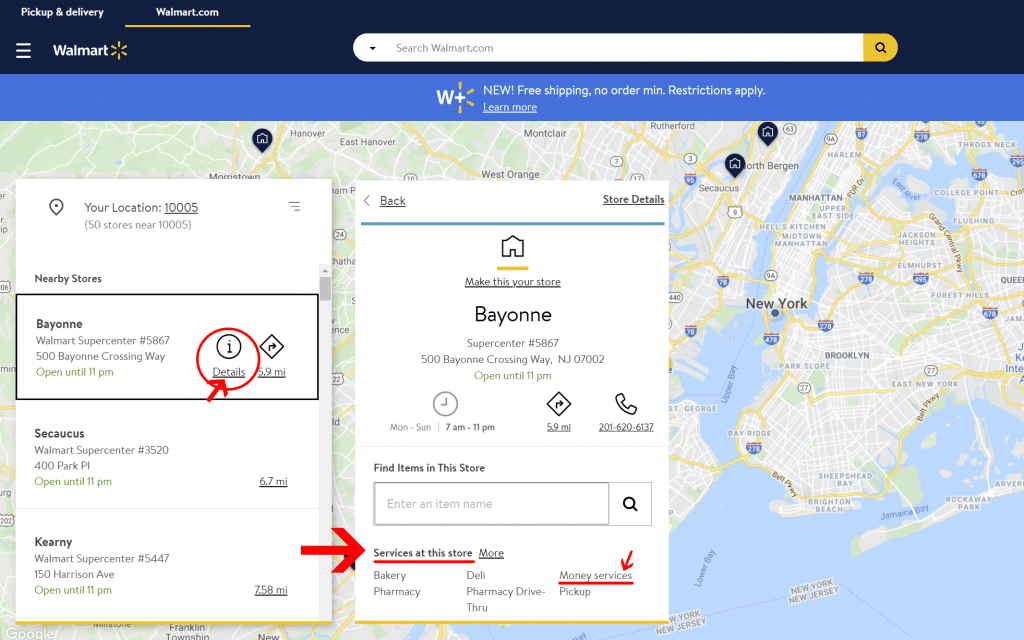

Not all Walmart stores are equipped to cash checks. To find one that is, use Walmart’s online Store Finder and look for one that offers “Money services.”

Related: How Much is Walmart Money Order? Domestic & International Price Chart

How to Find a Walmart Location that Cash Checks

There are over 4,700 Walmart locations in the United States. Over 90% of Americans live within 15 minutes of a Walmart store which makes Walmart a convenient place to cash a check.

The process of cashing a check at Walmart is quick and easy. Just follow the step-by-step instructions below.

- Find a Walmart store close to you using the online Walmart Store Finder

- On the list of the Walmart stores close to you, click on Details of your chosen store

- Make sure the term Money services is listed below the heading Services at this store. If not, it means this store is not equipped to cash checks. You would need to look for a different store

- On the same Store Details page under the store address, you will find the business hours of that store. As of Dec 2020, most Walmart stores are open 7 am to 11 pm, 7 days a week. However, different stores in different locations may have different business hours. So, pay attention to the business hours of your chosen Walmart stores. You do not want to go there when it is closed

- On the right side of the same Store Details page, you can also find the phone number of your chosen Walmart store. To be safe, you can call that store in advance to confirm their business hours and that they can cash your check

What You Need to Cash a Check at Walmart

To cash a check at Walmart, you need a valid government-issued ID such as a driver’s license, a state ID, or a passport. You may also need to give Walmart your Social Security number (SSN) before they would approve your check.

So, bring your Social Security card, or at least have your social security number memorized or written down on a piece of paper.

Make sure you have enough money with you to pay Walmart’s check cashing fees, which are either $4 or $8 depending on the amount of the check you are trying to cash.

Walmart will not cash your check unless it gets paid first, so do not count on taking money out of your check to pay for your check cashing fee.

You do not need to register with Walmart or have a Walmart credit or debit card to cash a check there.

However, if you want to deposit your check into your Walmart MoneyCard, you do have to bring your MoneyCard with you. Otherwise, you would have to spend the money ($1) to purchase a new MoneyCard.

Walmart puts a limit on the amount of a check you can cash there:

- Two-Party personal checks are limited to $200

- All other checks are limited to $5,000 (limit raised to $7,500 during tax season from Jan to Apr every year)

Related: What Time Does Walmart Money Center Open?

How to Deposit a Check to Walmart MoneyCard

How to Cash a Check at Walmart

To cash a check at Walmart, you do not need to register with them, you do not need to make a purchase, you do not need to have a Walmart account, and you do not need to have a bank account. Just follow the steps below:

- Go to your chosen Walmart store and find the Money Center or the Customer Service desk inside the store.

- Tell the Walmart associate who works there you want to cash a check, and hand over your endorsed check.

- Let the Walmart associate knows if you would like to deposit your check into your Walmart MoneyCard instead of cashing it. If you do, hand over your Walmart MoneyCard.

- You will be asked for your ID. Show them a valid government issued ID such as a driver’s license or a state ID. Sometimes, you may also be asked to give your social security number.

- The Walmart associate will then run your check through a scanning machine. Information from your check – such as its routing number, bank account number, and the amount of the check – together with your personal ID information will be fed into an electronic system to decide whether to approve or deny your check.

- If your check is approved, you will be asked to pay the check cashing fee (usually $4 or $8 depending on the amount of the check).

- After you pay the fee, you will receive your cash or your Walmart MoneyCard with your money loaded into it. If the process went through smoothly, it should take no more than 1 or 2 minutes.

If Your Check Got Denied at Walmart

The most common difficulty people have with cashing checks at Walmart is getting their checks denied.

Walmart uses outside systems to process its check cashing. Most Walmart locations use a system from TeleCheck, a check authorization service. A few Walmart locations use Certegy, a system similar to TeleCheck.

Both TeleCheck and Certegy use information about you, such as your ID and Social Security number, as well as the information on your check, such as its amount and routing number, to decide whether to approve or deny your check.

You may get denied if you have not cashed enough checks for the systems to build a sufficient file on your identity.

You may also get denied if the combination of your identity and the information on your check shows too much similarity with previous check cashing cases that are known to be frauds.

If TeleCheck or Certegy denies your check, there is nothing that Walmart can do. So it would be pointless to argue with the Walmart associate in that case.

If your check is denied, what you can do is to ask for the name of the system that Walmart location uses – TeleCheck or Certegy.

You can then contact either TeleCheck or Certegy and ask for the file they have on you. Go over that file to see if it contains any information that is inaccurate or incomplete.

If it does, bring it up with the company and make sure they correct their mistakes.

If you continue to get denied by Walmart for check cashing, go to cash your checks at a different place that does not use either TeleCheck or Certegy.

Alternative Places You Can Cash a Check

Your best bet is to cash your checks at a bank as most banks do not use either TeleCheck or Certegy.

You can also cash your checks at a grocery store, many of them, such as Hannaford and WinCo, also do not use either TeleCheck or Certegy.

Better yet, many banks and grocery stores charge lower fees for check cashing than that of Walmart (see table below.)

| Check Cashing Store / Retailer / Bank | Check Cashing Fee |

|---|---|

| Payday Loan Store | Up to 10% of total check amount |

| Ace Cash Express | 3% of total check amount |

| Speedy Cash | Varies - $2 minimum |

| PLS | 1% + $1 for checks up to $1,000 |

| Walmart | $6 for Two-party personal checks up to $200 $4 for checks up to $1,000 $8 for checks $1,000 - $5,000 |

| Kmart | $1 for Two-party personal checks up to $500 $1 for checks up to $2,000 |

| Kroger | $3 for checks up to $2,000 $5.50 for checks $2,000 - $5,000 |

| Publix | $3 to $6 |

| Fred Meyer | $4 for checks up to $2,000 $7 for checks $2,000 - $5,000 |

| Safeway | $2.25 for every $200 cashed |

| 7-Eleven | 0.99% of total check amount |

| WinCo | $5 for checks up to $500 $10 for checks $500 - $1,000 |

| Winn Dixie | $3.50 for checks up to $500 |

| Stop & Shop | $0.50 for checks up to $500 |

| Hannaford | $1 for checks up to $1,000 |

| Hy-Vee | $2 to $6 |

| Food City | $3 for checks up to $1,000 |

| Giant Food | $1 to $1.50 |

| Dillons | $3 for checks up to $2,000 $5.50 for checks $2,000 - $5,000 |

| Bank of America | $8.00 |

| Chase | $8.00 |

| Capital One | Free |

| Citibank | Free for checks under $5,000 |

| Wells Fargo | $7.50 |

| U.S. Bank | $5.00 |

| HSBC | Free for personal checks $3 for business checks up to $100 $5 for business checks of $100 or more |

| SunTrust | $7.00 |

| TD Bank | $7.00 |

| Citizens Bank | $7.00 |

Benjamin is a certified financial advisor, with over 10 years of experience in the industry. He is knowledgeable about various business and financial topics, such as retirement planning and investment management. Ben has been recognized for his work in the financial planning industry. He has also been featured in various publications.